Welcome to the world of personal finance! Whether you’re a newbie or an experienced financial guru, the world of personal finance can sometimes feel like a complex maze filled with fancy investments, opportunities, and crises.

Even seemingly straightforward financial decisions, such as paying off a loan or setting aside savings, can quickly become overwhelming. But fear not; today, we’re here to guide you through the financial wilderness with ten essential money formulas that everyone should know.

These formulas will not magically make all aspects of personal finance crystal clear, but they will provide you with a solid foundation to navigate common financial challenges. We’ll explore each formula in detail, offering real-world insights and practical advice to help you make informed decisions and build a brighter financial future.

Getting to Know Your Financial Position

Before diving into the intricacies of personal finance, it’s crucial to understand where you stand financially. These initial formulas will help you assess your current financial health and set the stage for future financial success.

Formula 1: Calculating Your Net Worth

Understanding your net worth is like having a map that shows your current location in the financial landscape. Your net worth reveals the difference between your assets (everything you own) and your liabilities (everything you owe). While this formula seems straightforward, it’s worth noting that assets and liabilities can have nuanced definitions.

Some financial experts, like Robert Kiyosaki, argue that assets are things that put money in your pocket, while liabilities take money out. For example, a home can be an asset if you rent it out but a liability if you’re solely responsible for its expenses. By understanding your net worth, you gain clarity on your financial standing and can make informed decisions about your next financial moves.

| Assets | – | Liabilities | = | Net Worth |

|---|---|---|---|---|

| Everything you own | – | Everything you owe | = | Your financial position |

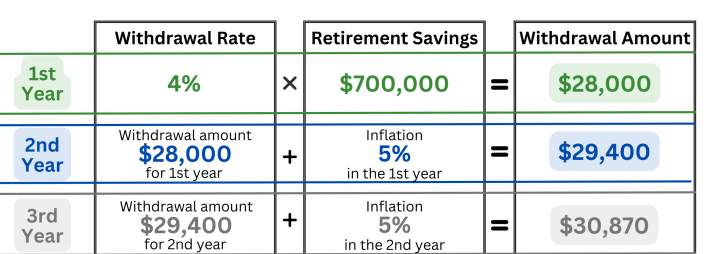

Formula 2: The 4% Rule for Retirement Planning

Now that you know where you are financially, let’s look ahead to your financial future. The 4% rule is a valuable tool for estimating how much you’ll need to retire comfortably. Coined by retired financial advisor William Benson, this rule suggests that you can safely withdraw about 4% of your savings in the first year of retirement and adjust this amount for inflation each year.

To make this rule work for you, consider maintaining a diversified investment portfolio, ideally split between stocks and bonds. Research shows that such a portfolio could sustain you for at least 30 years, regardless of when you retire. This means you should aim to save roughly 25 times your annual expenses not covered by other income sources, like Social Security. While this rule provides a starting point, it’s important to tailor your retirement plan to your unique circumstances.

| Retirement Savings | ÷ | 25 | = | Estimated Annual Retirement Income |

|---|---|---|---|---|

| Savings needed to retire comfortably | ÷ | A safe factor (25 in this case) | = | Financial security in retirement |

Formula 3: Understanding Your Cash Flow

Now that you’re on the path to financial security, let’s focus on tracking your progress. The cash flow formula is a simple yet powerful tool that reveals the difference between your income and expenses. Some prefer to calculate this using net after-tax income and expenses, which can be equally insightful.

Another key aspect of your cash flow is your fixed spending ratio. This metric measures the portion of your spending dedicated to unavoidable costs, often referred to as the “four walls” of your financial house. These expenses include shelter, food, utilities, transportation, clothing, and insurance. A lower fixed spending ratio provides greater financial flexibility during challenging times.

| Income | – | Expenses | = | Cash Flow |

|---|---|---|---|---|

| Money you earn | – | Money you spend | = | Your financial progress |

Formula 4: The Financial Runway

Building on the fixed spending ratio, the financial runway formula assesses your financial sustainability and risk. It calculates how long you could cover your expenses if you suddenly lost your income, comparing your liquid monetary assets (excluding non-liquid assets like your home or car) to your monthly or yearly expenses. This metric provides a safety net in uncertain times.

| Liquid Assets | ÷ | Monthly or Yearly Expenses | = | Financial Runway |

|---|---|---|---|---|

| Available cash and investments | ÷ | Monthly or yearly costs | = | Financial stability |

Formula 5: Measuring Your Debt Load with Leverage Ratio

Managing debt is a fundamental aspect of personal finance. The leverage ratio formula helps you gauge your current debt load by dividing your total debt by your net income. Lenders often use this formula when assessing loan applications.

Understanding your leverage ratio ensures you don’t take on more debt than you can handle.

| Total Debt | ÷ | Net Income | = | Leverage Ratio |

|---|---|---|---|---|

| All debts you owe | ÷ | Your total income | = | Debt management |

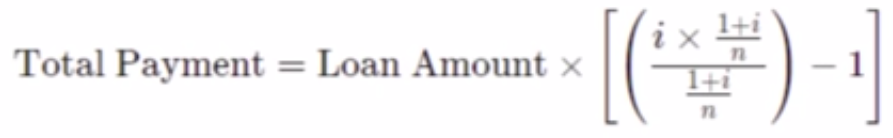

Formula 6: Minimum Payment Calculation

Before taking on new debt, it’s essential to consider how it will impact your financial situation. The minimum payment formula helps you determine the financial burden a new debt would impose. It calculates the minimum monthly payment based on the interest rate and the number of payments required.

| Minimum Payment | = | Loan Amount × (Interest Rate / Number of Payments) |

|---|---|---|

| Minimum payment amount | = | Principal amount × (Monthly interest rate) |

Investing in Your Financial Future

With your financial foundation established, let’s delve into the world of investing. These formulas will help you assess the performance of your investments and make informed decisions about your financial future.

Formula 7: Calculating Return on Investment (ROI)

Return on investment (ROI) is a critical metric for assessing the performance of your investments. It can be calculated in various ways, such as short-term price changes, total returns, compounded returns, or inflation-adjusted returns. Understanding ROI helps you evaluate the growth and profitability of your investments.

| ROI | = | [(Ending Value – Beginning Value) / Beginning Value] × 100 |

|---|---|---|

| Return on investment percentage | = | [(Current investment value – Initial investment value) / Initial investment value] × 100 |

Formula 8: The Rule of 72 for Investment Growth

The Rule of 72 is a handy tool for estimating how long it will take your investments to double in value. By dividing 72 by your rate of return, you can determine the approximate number of years required for your investments to grow. This rule allows you to assess investment growth both nominally and adjusted for inflation.

| Years to Double Investment | ≈ | 72 ÷ Annual Rate of Return |

|---|---|---|

| Time for investment to double | ≈ | 72 ÷ |

Investment’s annual growth rate |

Formula 9: Money as Hours of Life Equivalent

This formula provides a unique perspective on your financial decisions by translating them into the time cost instead of the financial cost. For example, it can help you evaluate how many hours of work it takes to afford a particular purchase. This approach encourages intentional spending and financial mindfulness.

| Money as Hours Equivalent | = | Cost of Purchase ÷ (Hourly Wage × Hours Worked) |

|---|---|---|

| Time cost of a purchase | = | Purchase price ÷ (Your hourly wage × Number of hours worked) |

Formula 10: Lifetime Wealth Ratio

The Lifetime Wealth Ratio is a powerful measure of financial efficiency. It compares your net worth to your total lifetime income, offering insights into how effectively you’ve managed your finances over the years. This formula helps you appreciate those who’ve achieved financial success with lower incomes and highlights the importance of wise financial decisions.

| Lifetime Wealth Ratio | = | Net Worth ÷ Total Lifetime Income |

|---|---|---|

| Financial efficiency ratio | = | Your financial wealth ÷ Lifetime earnings |

Conclusion

These ten money formulas provide a solid foundation for mastering your finances. While this list isn’t exhaustive, it equips you with essential tools to assess your financial position, plan for retirement, manage your cash flow, and make informed investment decisions.

Remember that personal finance is a journey, and there’s always more to learn and explore. Continuously fine-tune your financial strategy, adapt to changing circumstances, and seek professional advice when needed. With the knowledge and insights gained from these formulas, you’ll be better equipped to navigate the complex world of personal finance and build a secure and prosperous financial future.